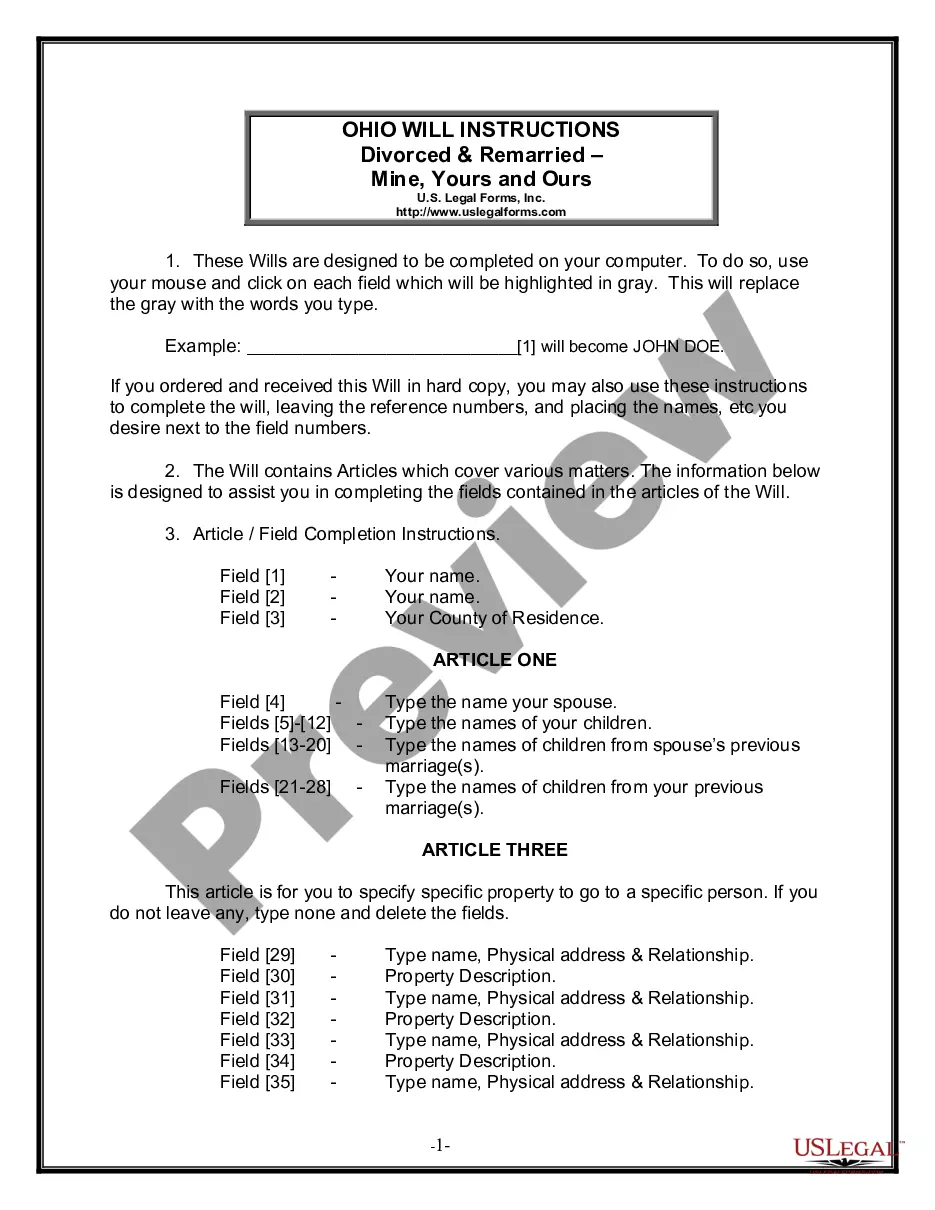

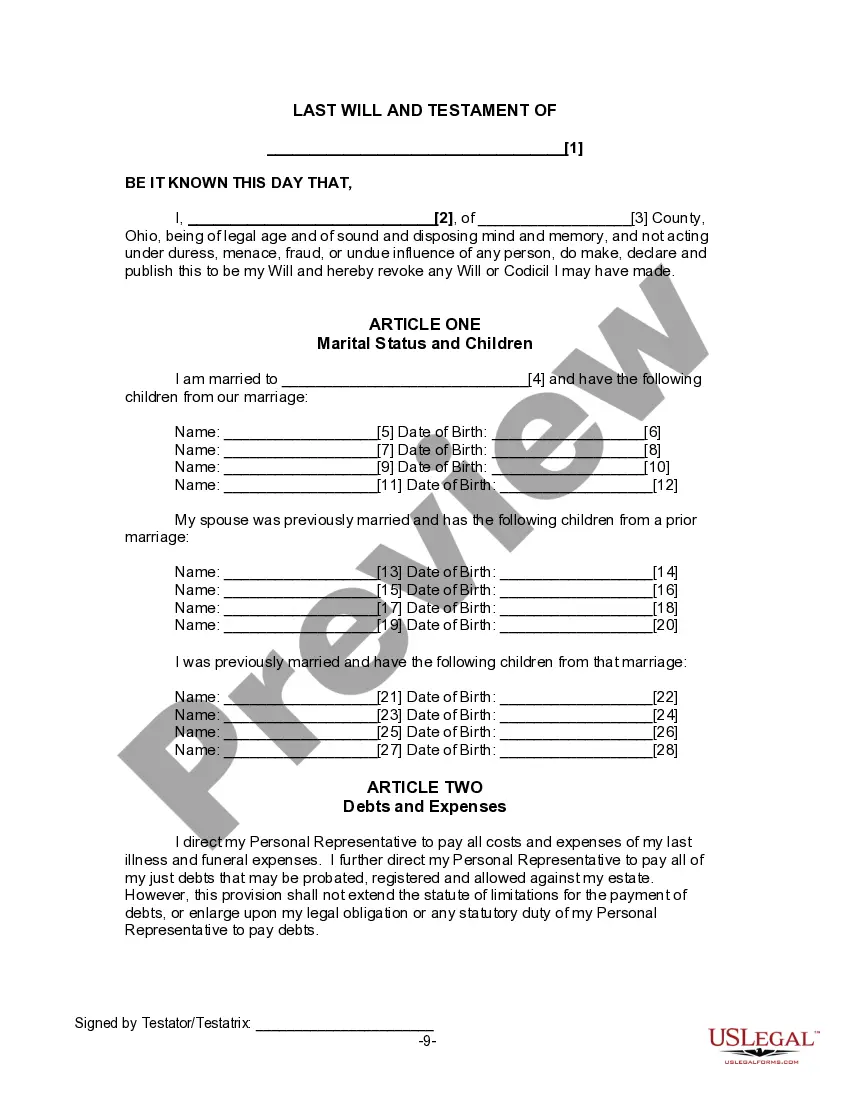

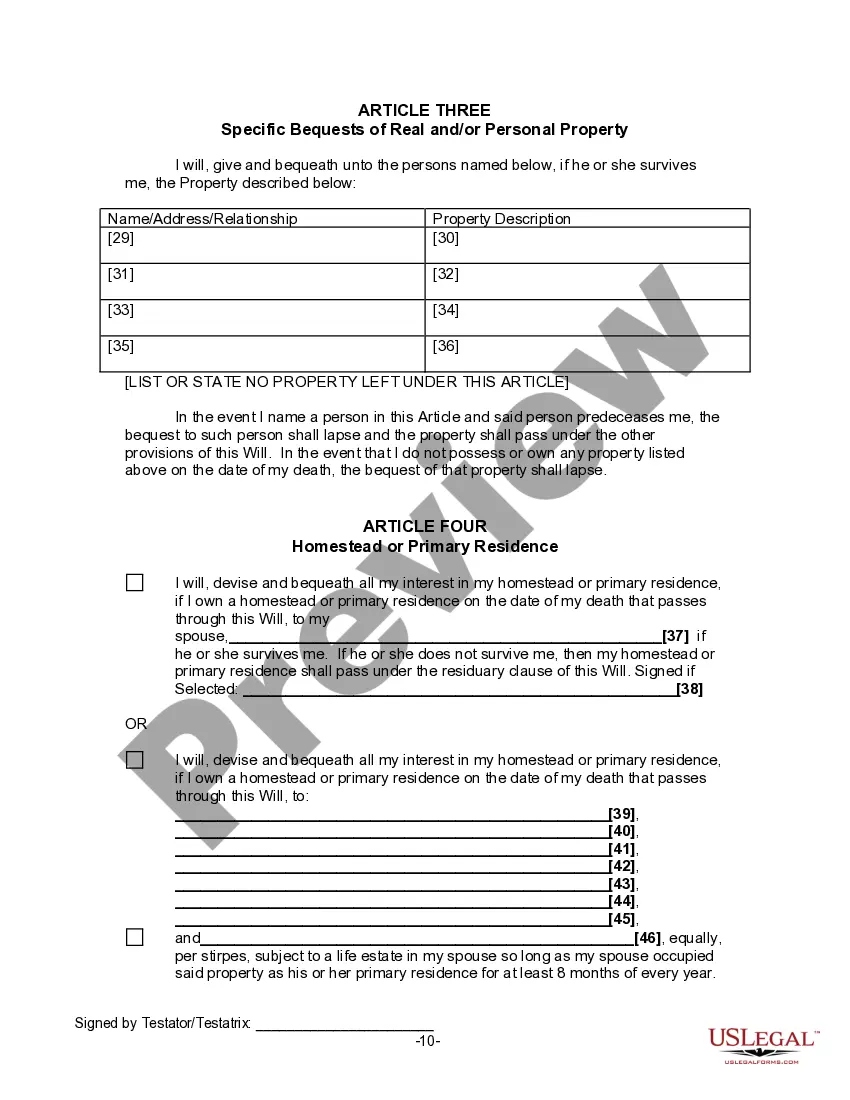

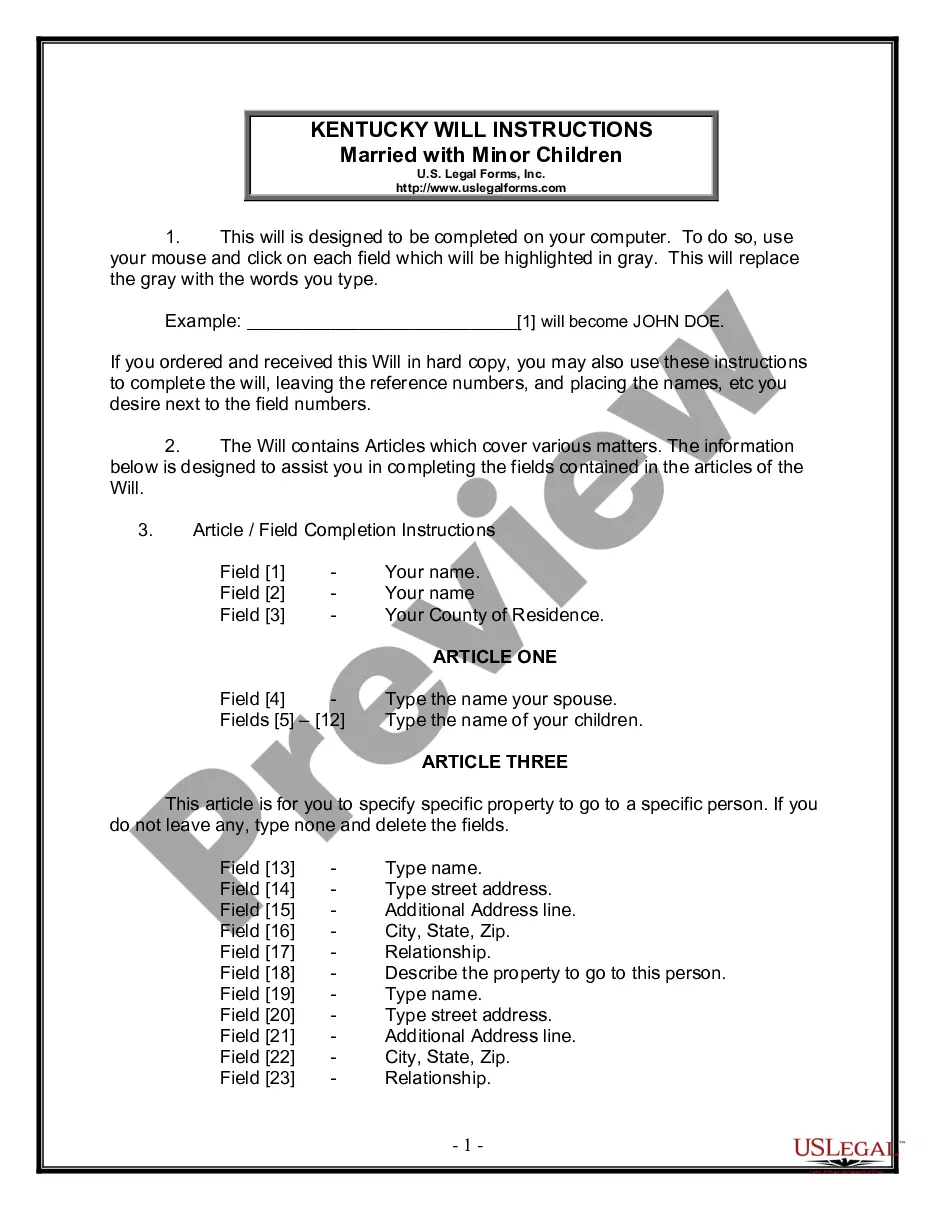

This is a Legal Last Will and Testament Form with Instructions for Divorced and Remarried Person with Mine, Yours and Ours Children. The will you have found is for a divorced person who has remarried. This will is to be used when there are children of the present marriage and either one or both spouses have children from prior marriages. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions. It also establishes a trust for the estate left to the minor children.

This will must be signed in the presence of two witnesses, not related to you or named in your will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the will.

Title: Ohio Legal Person with Recognized Antigens — Types and Detailed Description Introduction: Ohio is a state within the United States that legally recognizes certain entities as "legal persons" with recognized antigens. These entities are identified by their unique characteristics and have legal rights and responsibilities similar to those of individuals. In this article, we will delve into the different types of Ohio legal persons with recognized antigens, highlighting their key features and implications. Types of Ohio Legal Persons with Recognized Antigens: 1. Corporations: A corporation is a legal person created under the laws of Ohio, enabling it to have its own distinct identity, rights, and obligations. Corporations are established for various purposes, including commercial, nonprofit, or charitable endeavors. They can acquire assets, enter into contracts, sue or be sued, and enjoy limited liability, separating their actions from individual stakeholders. 2. Limited Liability Companies (LCS): LCS are a popular business structure in Ohio, offering both the limited liability protection of a corporation and the flexibility of a partnership. As legal persons, LCS have their own standing in the eyes of the law, separate from their owners or members. LCS can engage in various activities, sign contracts, own property, and generally conduct business, shielding their members' personal assets from potential liabilities. 3. Nonprofit Organizations: Nonprofit organizations are another type of Ohio legal person with recognized antigens. These entities operate for specified purposes such as charitable, educational, religious, or scientific endeavors rather than generating profits for their members. Nonprofits must comply with relevant regulations and have their own legal standing, allowing them to receive and disburse funds, own assets, and advocate for their cause. 4. Trusts: Trusts are legal entities established to hold and manage assets on behalf of beneficiaries. In Ohio, trusts are recognized as legal persons with recognized antigens and can be created for various reasons, such as estate planning, asset protection, or charitable endeavors. Trusts enable individuals or entities to transfer assets to a separate entity managed by a trustee, overseeing their distribution according to specified terms. Detailed Description: Ohio legal persons with recognized antigens hold significant importance in various legal and business contexts. These entities possess considerable autonomy and limited liability protection, allowing them to engage in economic activities, enter into contractual agreements, hold property, and pursue legal actions. Corporations, as Ohio legal persons, can be classified into different types, including C Corporations, S Corporations, and Benefit Corporations. Each type holds its own set of characteristics and compliance requirements, tailored to specific purposes and goals. Limited Liability Companies (LCS) are a hybrid entity type, combining attributes of corporations and partnerships. Individuals and entities forming LCS are known as members, and their ownership interests define their rights and obligations within the company. LCS provide flexibility in management, taxation options, and limited liability protection. Nonprofit organizations are recognized as legal persons and encompass a wide range of entities, such as charities, foundations, religious organizations, and educational institutions. These entities enjoy tax-exempt status under specific conditions, allowing them to focus on their missions and activities without pursuing profits for private individuals. Trusts are established through legal instruments (trust agreements) and recognized as separate legal entities in Ohio. Trusts enable individuals to manage their assets and plan for the distribution of wealth or philanthropic endeavors. They involve three key parties: the granter (creator), trustee (managing the assets), and beneficiaries (who benefit from the trust). Conclusion: Ohio legal persons with recognized antigens are diverse and play a crucial role in the state's legal and business environments. Understanding the different types of legal persons, such as corporations, LCS, nonprofits, and trusts, helps individuals and entities make informed decisions when establishing their legal structures. The recognition and legal protections afforded to these entities provide a framework for economic growth, asset protection, and philanthropic initiatives throughout Ohio.